Economic Confidence and Consumer Spending in SA

The first quarter of 2025 had a shaky start for South African consumers. The buzzing question fellow South Africans had was ‘Vat Gaan Aan?’, a question inspired by Nandos. Given the South African economic climate, the notion of a Value Added Tax (VAT) increase hurt the economic confidence of fellow South Africans.

Therefore, this article aims to take you on a South African economic journey, exploring how factors such as employment, inflation, and interest rates impact consumer confidence and shape consumers’ spending habits. The insights are backed by data from Bateleur Brand Planning’s 2024 annual Vantage Point Research.

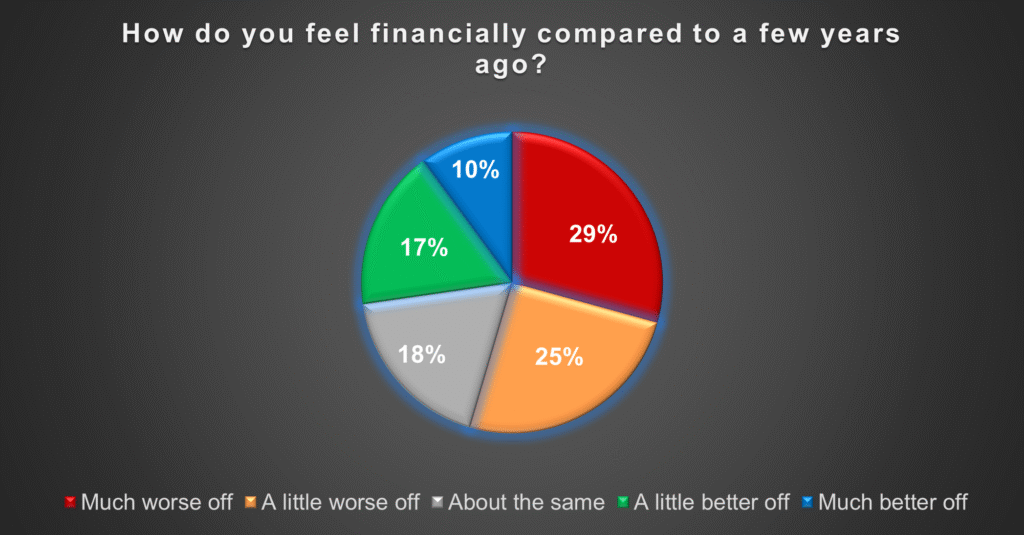

Individual Experiences of Financial Security Over Recent Years

(Source: Bateleur VantagePoint Data, 2024).

South African consumers were asked to reflect on how they feel about their financial situation now compared to how they felt before. The highest percentage, 29%, reported feeling much worse off, indicating that a significant portion of the population is under financial pressure. In contrast, only 10% said they feel much better, which is the lowest reported sentiment regarding their current financial standing. The numbers indicate that consumer confidence in South Africa is low.

South African Consumer Confidence is impacted by the following Economic Factors

1. Jobless Pressure: The Weight of Unemployment on South Africans Today

South Africa’s official unemployment rate sits at 32.9%, meaning nearly one in three working-age South Africans is without work (Trading Economics, 2025). This signals a growing economic uncertainty, making consumers more likely to hold back on spending, especially on non-essential items. When people don’t feel secure in their jobs or can’t find work at all, their focus shifts to survival rather than growth. This cautious approach to spending not only slows down the economy but also reflects a deeper lack of confidence in what lies ahead.

i) Shopping choices reflect confidence gaps

Among unemployed South Africans, 17% prefer shopping in-store, compared to just 8% who opt for online shopping, a sign of cautious, price-sensitive buying behaviour. In contrast, full-time employees show a more balanced trend, with 11% shopping online and 9% in-store, hinting at slightly higher confidence and access to digital convenience. These patterns reflect how job security or the lack of it shapes not just spending power, but also how and where consumers choose to spend.

2. The Cost of Credit: How Interest Rates Shape Everyday Choices

The repo rate dropped from 7.50% to 7.25%, and the prime lending rate decreased from 11.00% to 10.75% on the 29 of May 2025 (Private Property, 2025). This makes credit slightly cheaper, meaning lower repayments on loans, bonds, and other forms of debt. For many South Africans feeling worse off financially, even a small reduction in monthly expenses can ease the burden. This may help restore confidence among consumers, particularly those who are highly indebted or reliant on credit. At a time when every rand counts, a lower interest rate can shift the mood from survival to breathing room, and that shift matters for the economy as a whole.

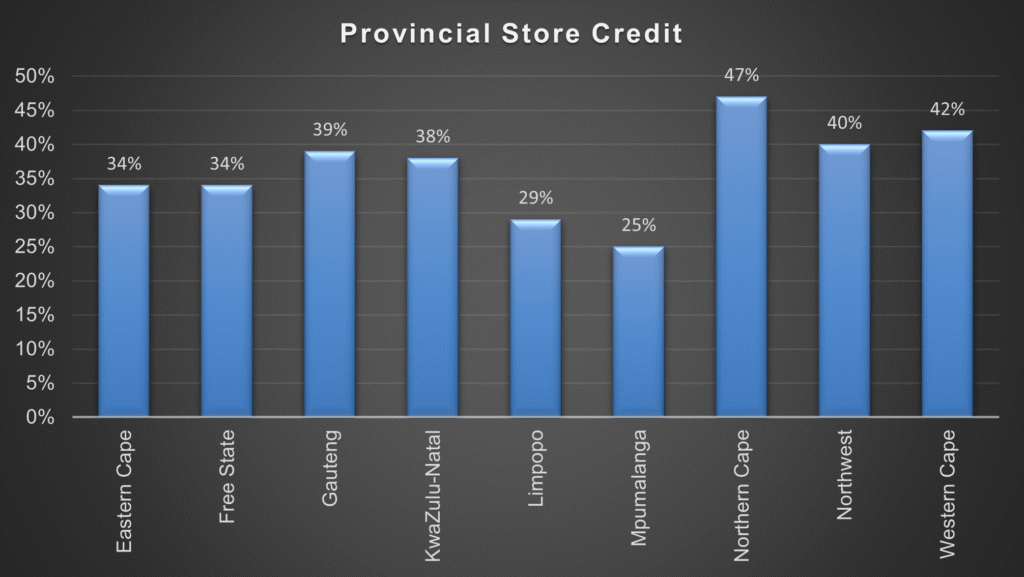

i) Trusting the Till: South Africa’s Take on In-Store Credit

(Source: VantagePoint Data, 2024).

Provincial data shows that in-store credit is most commonly used in the Northern Cape (47%), Western Cape (42%), and Northwest (40%), highlighting a greater dependence on credit as a financial buffer. Even in economically active areas like Gauteng (39%) and KwaZulu-Natal (38%), uptake remains high. On the other hand, provinces like Mpumalanga (25%) and Limpopo (29%) show more cautious usage. These patterns reflect varying levels of economic confidence, where in some areas, store credit is not just a convenience, but a necessary tool to bridge the gap between rising costs and limited income

3. Rising Prices, Shrinking Pockets: The Everyday Impact of Inflation

South Africa’s annual inflation rate remained relatively low and stable in early 2025, with Statistics South Africa reporting a rate of 3.2% in January, up slightly from 3.0% in December 2024. According to Trading Economics, April’s inflation rate stood at 2.8%, up marginally from 2.7% in March. These figures are comfortably within the South African Reserve Bank’s (SARB) target range of 3% to 6%, indicating a period of price stability. In line with this trend, the SARB revised its headline Consumer Price Index (CPI) inflation forecast for 2025 downwards in March from 3.9% to 3.6%, reflecting more optimistic expectations around inflation management (Trading Economics, 2025). This environment of subdued inflation supports economic confidence, as consumers are less likely to feel squeezed by rising living costs and may feel more secure in their ability to budget and plan financially.

i) Smart Spending in Tough Times

With the rising cost of products and services, South African consumers across all income levels are leaning into discounts, coupons, and rewards programmes to stretch their rands further. Even among households earning R5 000 or less, 60% actively seek out these savings, while 65% of those in the R50 000 to R59 999 income bracket do the same. This trend highlights a broader sense of cautious spending and financial restraint, showing that no matter the income, confidence in long-term affordability remains fragile.

Conclusion

Across provinces and income levels, people are finding ways to make their money go further, whether through in-store credit, rewards programmes, or by adjusting their spending habits in response to shifts like the recent interest rate cut and controlled inflation levels. Even higher-earning households are not immune to pressure, with many turning to discounts and savings strategies once seen as the domain of lower-income brackets. Though rising debt costs and limited state relief continue to challenge public sentiment following the 2025 Budget, what’s clear is that a cautious yet hopeful energy is emerging. Every rand is being spent more mindfully, rooted not in excess, but in survival, strategy, and slowly rebuilding trust in the economy.

Closing Thoughts

We at Bateleur Brand Planning would love to hear your thoughts on what you think about the South African economic confidence. Do you also count days before pay, because financially, you would be critical but stable?

Side Note: Kudos to you for reaching this point. I hope you found the article worth your time.

Sources

1. Trading Economics. (2025). South Africa unemployment rate. Available at:

https://tradingeconomics.com/south-africa/unemployment-rate [Accessed: 18 June 2025].

2. Private Property. (2025). Interest rate drop in May 2025. Available at:

https://www.privateproperty.co.za/advice/property/articles/interest-rate-drop-in-may-2025/9532 [Accessed: 18 June 2025].

3. The Cup of Z. (2020). Online shopping v/s offline shopping. Available at:

https://thecupofz.wordpress.com/2020/04/29/online-shopping-v-s-offline-shopping/ [Accessed: 19 June 2025].

4. Trading Economics. (2025). South Africa inflation rate (CPI). Available at:

https://tradingeconomics.com/south-africa/inflation-cpi [Accessed: 19 June 2025].

If you enjoyed this article, signup below to receive more:-